How Fractional-Reserve Banking Really Works

When you are thinking about investing in commercial property, you are probably talking about big numbers. While your broker can help you with some of the complicated banking, the more you learn as a consumer, the better for you.

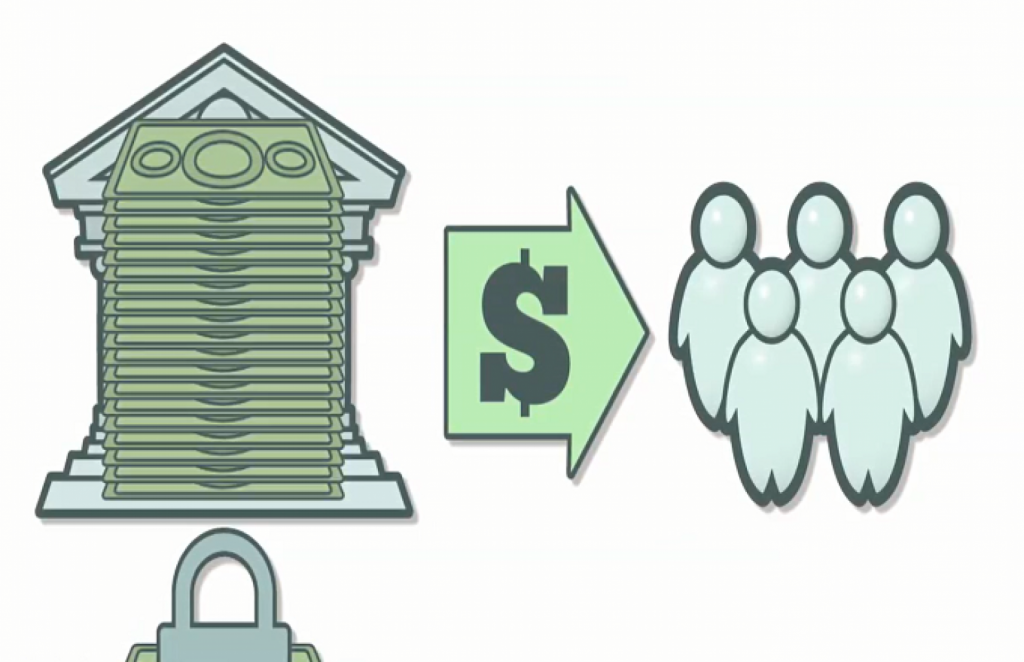

Fractional-reserve banking is a term you may have heard. It sounds complicated (and it can be), but how many of us have really taken the time to look behind the veil and learn just how this system really operates?

Here’s a quick overview:

Banks are required to keep reserves on hand equal to a percentage of their total deposit liabilities, which can fluctuate-most use the 10% figure. Let’s say you’ve been finding $100 bills from the infamous “Benny” and when you get to $1,000 you deposit in your bank. The bank must keep $100 and can loan out the $900.

When the bank loans out the additional $900.00 to a Willamette student for an awesome television, then the student begins paying interest on the loan. The bank still has the original $1,000.00, and it has now made a $900.00 loan our student, as an electronic deposit into his checking account. This means that there’s $1,900.00 in new money in the banking system that came from the original $1,000.00 deposit.

So where did this additional $900.00 come from? It snapped into existence now that the $900.00 loan was given to the borrower.

If you are a little confused, don’t give up yet. There is a happy ending and with fractional-reserve banking, the story of our $1k gets even more interesting.

Let’s say, for example, that our student, who borrowed the $900.00 from the bank, buys his TV at Kelly’s Home Center for $900.00, and then that $900.00 is then deposited into the Kelly’s business bank. So, their bank now has an additional $900.00 in new deposits, and they can now loan out $810.00 (90%) of that money. Remember they are keeping $90.00 (or 10%) as the required reserve.

This then continues building throughout the entire banking system, as more deposits are then made from these additional loans and the purchases that come from them, until ultimately the banking system can then create approximately $9,000.00 in new loans from that initial $1,000.00 deposit. How is that for being simple and complicated at the same time. Just believe the system works !

Alex Rhoten is the Principal Broker at Coldwell Banker Commercial Mountain West Real Estate at 503-587-4777 or cbcre.com